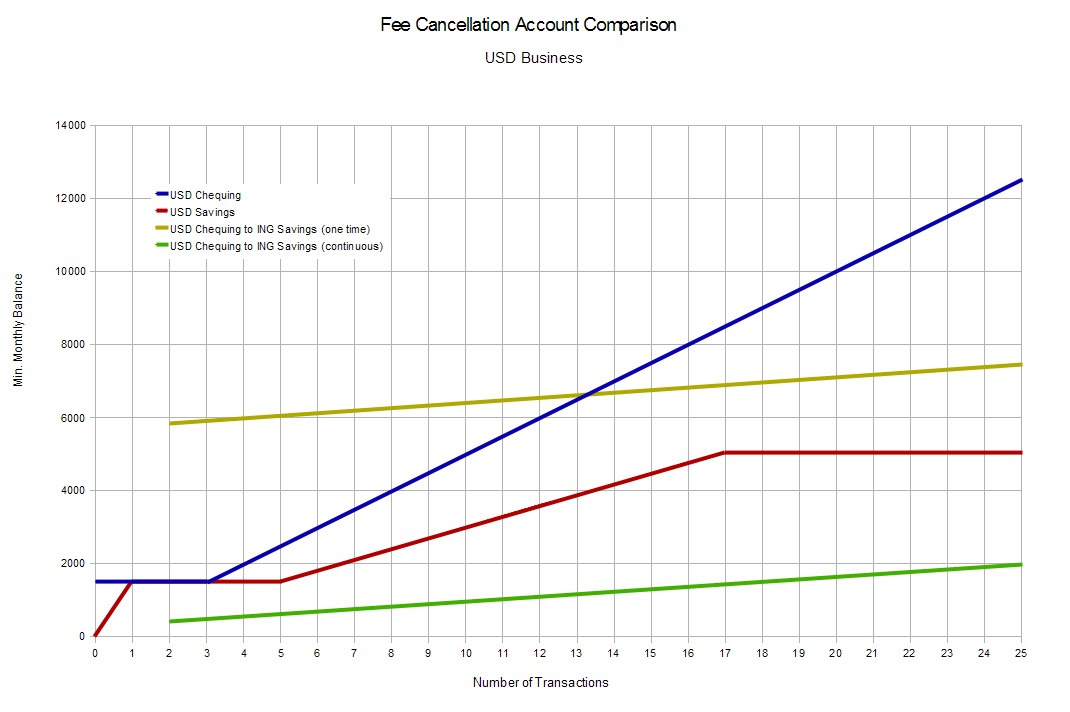

Like many of you, especially those of you living just a little further south, I sometimes get paid in USD. All good, except wait. This country claims to have its own proprietary currency (CDN). And so I embarked on a long and complicated journey to find the best ‘deal’ for a USD Business account. I wanted to see which account performed better over which ranges. It ended with this graph:

It is important to note that what we are listing here are the points at which the accounts pay for themselves.

In generating the above graph, I make the assumption that all transaction fees are $0.75 (all we’re doing is depositing/withdrawing). The USD Chequing and Savings accounts are both from Vancity bank (which looked to have the best deals of the five or so I looked at). The chequing account waives the $3 monthly fee for a minimum monthly account balance of $1500, and you get one free transaction for every $500. The savings account offers no monthly fee, and a tiered interest rate.

The $5000 plateau ends at 27 transactions for the USD Savings account, and continues upward with a slope equivalent to the 0.4% interest.

It seems as if there is no point in which the USD chequing account does better than the USD savings account, in addition to the fact that higher balances in the savings account would result in profit while the same cannot be said for the chequing account.

The next point was to combine the Vancity USD Business Chequing account with the higher interest earning ING USD Savings account.

There are two lines for the Vancity USD Business Chequing to ING USD Savings. This has to do with one-time fees such as cheques (You need to send a cheque to ING so they can set up the link). I’ve assumed $60 (this is a guess), but it could be more or it could be free (I have yet to inquire). The point is it isn’t recurring, which means with a monthly balance of the yellow line for a single month, you then drop down to the green line.

In reality, we could average it over the life of the account and the translation would probably be minimal.

The Vancity USD Business Chequing to ING USD Savings refers to the minimum monthly balance of the ING account, on which you receive 1.1% interest. The $3 monthly fee as well as the vancity transactions are being countered by the interest earned via the ING account. In effect, we are assuming that the minimum monthly balance of the Vancity chequing account is $0 (or at least < $500). If you would like to generate your own table of values, or see mine, I’ve provided a php script for that purpose.

Keep in mind the graph or values could be inaccurate if I happened to make any typos, but they should help you get an idea as to how the accounts differ.